FinNexus Blog

FinNexus Blog

A Comparison of Decentralized Options Platforms

Ryan Tian — July 25th 2020

The next big DeFi opportunity

The crypto world has recently exploded in excitement over the concept of liquidity mining for the governance token of a key DeFi platform. We are talking about Compound’s COMP token, which catapulted the decentralized borrowing and lending protocol to the top of the DeFi charts in the space of less than a week. Liquidity mining itself is not a new concept, but the COMP frenzy turned it into a “yield farming” meme sensation.

Compound is a simple money market protocol. It will play an important part in the DeFi landscape of the future, yet it is but one piece of the vast array of DeFi protocols we anticipate will increasingly become viable replacements for financial services that are now only available via centralized solutions.

One of the contenders among DeFi protocols and platforms to be the next sensation and attract large amounts of capital are decentralized options protocols. This long form article reviews seven decentralized options platforms that have either recently launched or are still in the testnet phase.

The authors of this piece, Ryan Tian and Nicholas Krapels, are currently involved in the design of their own decentralized options protocol at FinNexus. We felt that making this research public would contribute to the DeFi community. We hope you enjoy it!

Overview

The front page of Defiprime proclaims:

“Decentralized Finance (DeFi) is the movement that leverages decentralized networks to transform old financial products into trustless and transparent protocols that run without intermediaries.”

With DeFi lockup value rallying since it plummeted on Black Thursday back in March 2020, the Total Value Locked (TVL) in DeFi, as tracked by Defipulse, has now obliterated its once magical $1 billion threshold, much thanks to the growth in Compound and WBTC. Furthermore, it seems like every day a new project announces its entry into the DeFi Lego Universe. For more about what this “composability” means, take a look at Nicholas Krapels’ essay:

Does FinNexus Have Competitors?

*The emerging DeFi system does not yet have much zero-sum competition. Collaboration is the DeFi ethos.*

Most of the early successful projects in the DeFi space - namely Maker, Compound, and Aave, all money market protocols with a combined $1.16 billion of TVL at the time of writing - focus on providing a trustless means to lend out and borrow against your crypto assets.

Those three platforms alone account for the majority of today’s DeFi assets. But we at FinNexus think that these types of building blocks lie at the very basic layers of the DeFi protocol stack. We believe that there is a Cambrian explosion of new DeFi functionality to come that will bring the functionality of Ethereum to other chains and vice versa, as well as developing as yet unforeseen ways of stacking these Money Legos together.

Derivatives

The holy grail in traditional financial markets are derivatives. Depending on who you ask, financial derivatives are seen anywhere from being an Angel that brings an opportunity to small investors to a Demon that wreaks havoc on financial markets, the bringers of recessions. The traditional derivatives markets are estimated to involve notional amounts over $1 quadrillion. Historically, this enormous market has played an indispensable role in growing global financial markets, providing massive enrichment to financial instruments and trading strategies deployed using them. Hence, derivatives markets are the feedback loop that provides depth to financial markets and reinforces the value of those markets’ underlying assets. As the DeFi movement inexorably marches towards this field, the opportunity to protocols is enormous.

Derivatives are often referred to as an instrument, with a value that is reliant upon or derived from an underlying asset or group of assets. Futures contracts, forwards, options, and swaps are typical derivatives on traditional financial markets.

In crypto markets, centralized exchanges have already seen significant volume in centralized derivatives products. Binance, BitMEX, Huobi, OKex, and more all have retail-facing futures platforms, but no options yet. Options products are available to retail investors via Deribit, FTX, and LedgerX. For institutions looking specifically for bitcoin exposure, there is sufficient liquidity on the Chicago Mercantile Exchange (CME).

It is reported by CryptoCompare that derivative volumes hit a new all-time high in May 2020, with a notable increase in trading activity around crypto options.

The next phase in DeFi development will be to develop decentralized protocols that mimic the functionality of these centralized Market Monsters. The statistics above show a quarter-over-quarter growth in derivatives volume of nearly 100%. If the DeFi movement overall is still a child, decentralized derivatives are the new-borns, but growing fast. Last year, we witnessed the rise of Dydx and Synthetix. This year has already seen the launch of some very promising DeFi projects like Futureswap, a decentralized version of the futures exchange platforms mentioned above, and UMA, a highly innovative project that touts its “provably honest oracle mechanism to create your own financial products.”

Options have always been among the platoon leaders in the derivative army. While the centralized options platforms mentioned above are now trading, decentralized options platforms are the new recruits to the DeFi Movement. They are a welcome addition to the DeFi universe, because as the TVL increases to $10 billion and more over the next months and years, DeFi participants will need a convenient decentralized mechanism to help them manage their risk exposures.

This post will focus on the current options minting platforms available on the market right now. To review some of the essential terms for understanding options, we refer you to Ryan Tian’s other posts here:

The FinNexus Guide to Options Terms

*Options aren’t difficult if you keep in mind these few things.*

The FinNexus Guide to Using Options

*Before you put your funds to work, you should first understand all that options can be used for.*

A preview of the decentralized options platforms:

OPYN

OPYN is an options platform built on “Convexity Protocol,” which is a generalized options protocol built on the Ethereum blockchain that allows users to create options using oTokens. The opyn.co interface provides an easy-to-use interface to buy and sell put and call options on ETH.

OPYN made its first trial on the market for margin trading services in 2019, but pivoted towards a protection and insurance platform in February 2020. Users can buy protection for their Compound.finance deposits against both technical and financial risks. Later in March, OPYN launched its first series of protections for ETH holders. These initial oTokens were ETH put options where liquidity was provided via Uniswap. As such, all of these products can be seen as insurance for DeFi users. Initially, OPYN was not just another protocol for speculation.

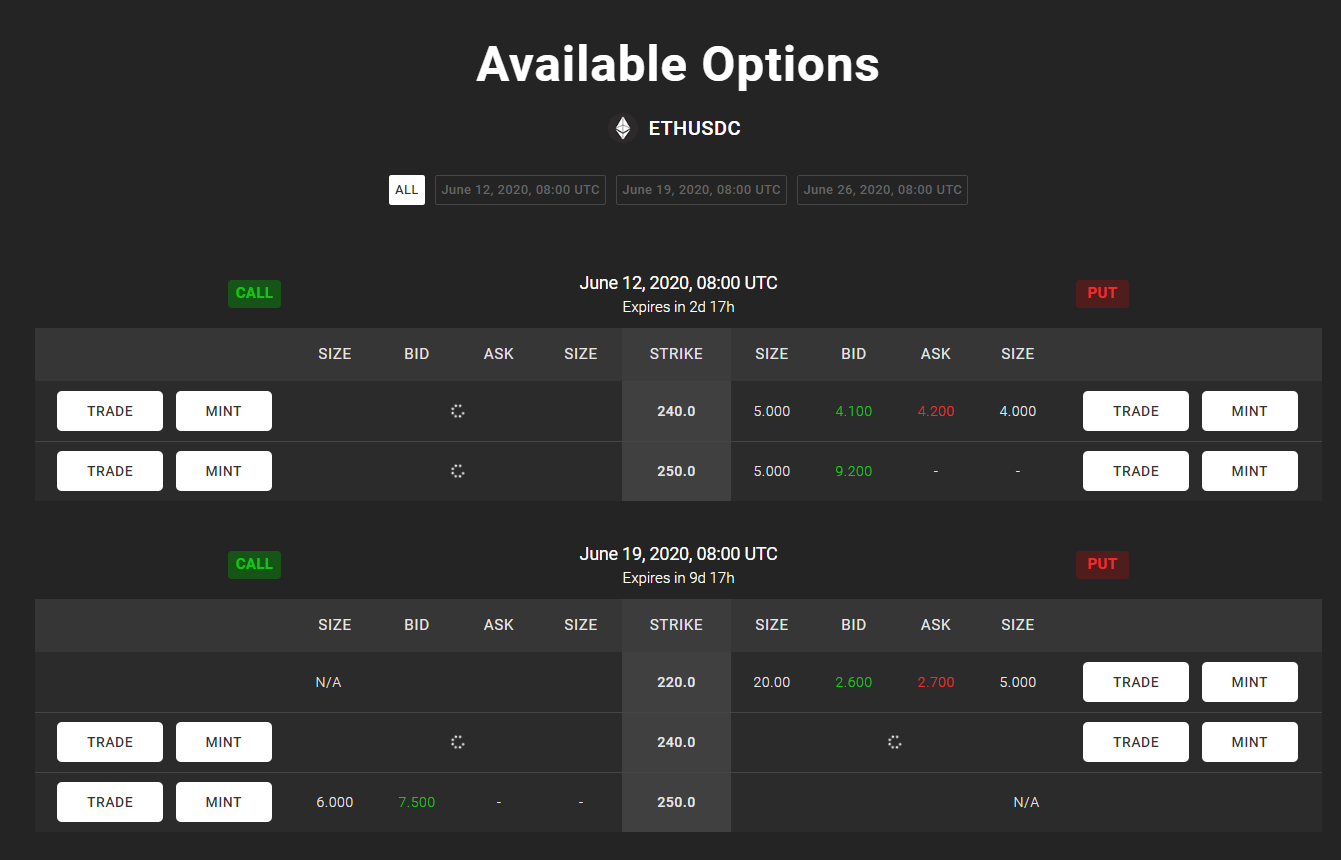

The picture below is the four ETH puts and one call that were available on OPYN on 15th June 2020.

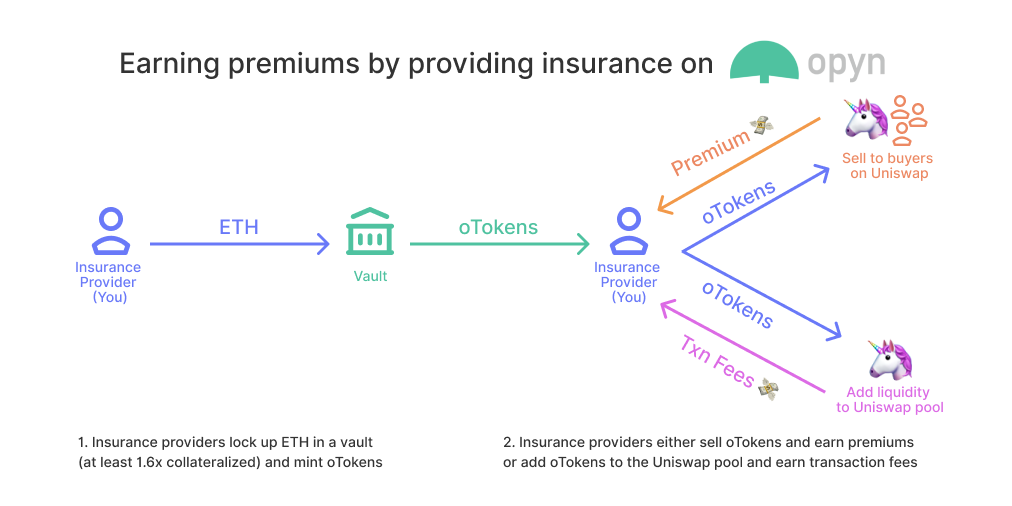

The oTokens are supported by the Convexity Protocol through oToken smart contracts. Each instance of an oToken smart contract must specify some of 8 different parameters: (1) time of expiry, (2) underlying asset, (3) strike price, (4) strike asset, (5) call or put, (6) type of collateral, (7) margin requirement of collateral, and finally (8) whether the option is either American or European. In order to focus liquidity on only a few markets, OPYN is currently the only entity that can specify these parameters and create specific oTokens at the moment. Options sellers then create options by locking up collateral for the period of time specified in the interface and minting oTokens. Each oToken protects a unit of the specified underlying asset. Options sellers sell these oTokens on Uniswap to earn premiums.

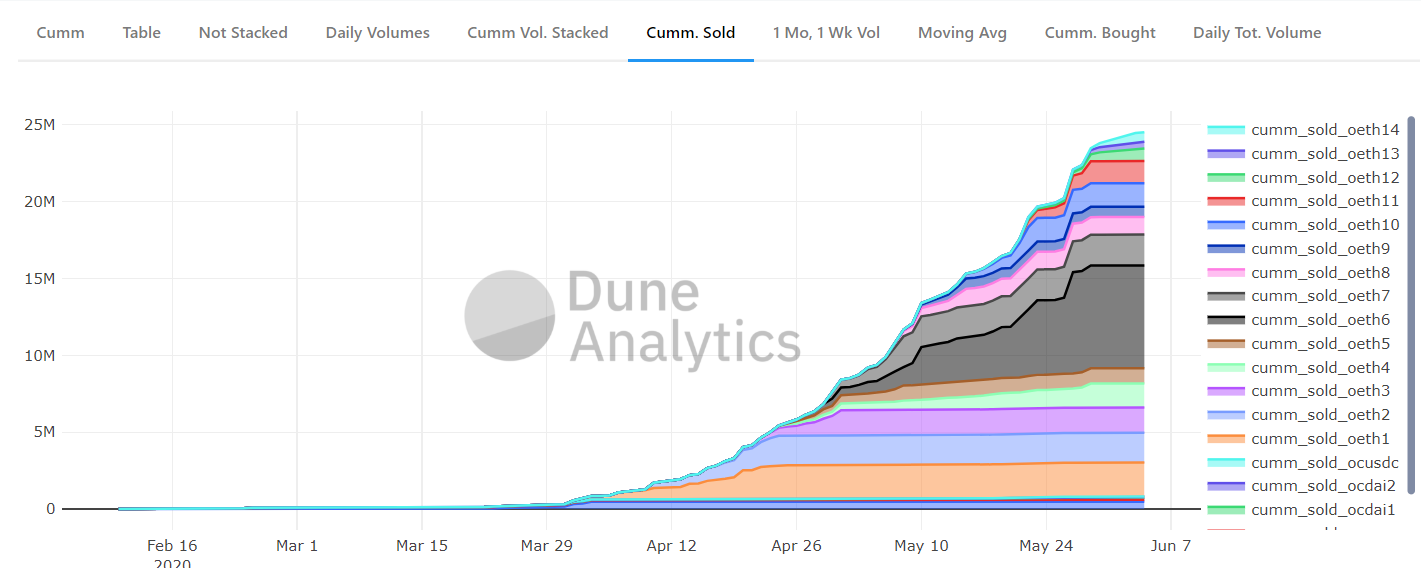

According to Dune Analytics, the OPYN options products are picking up pretty fast.

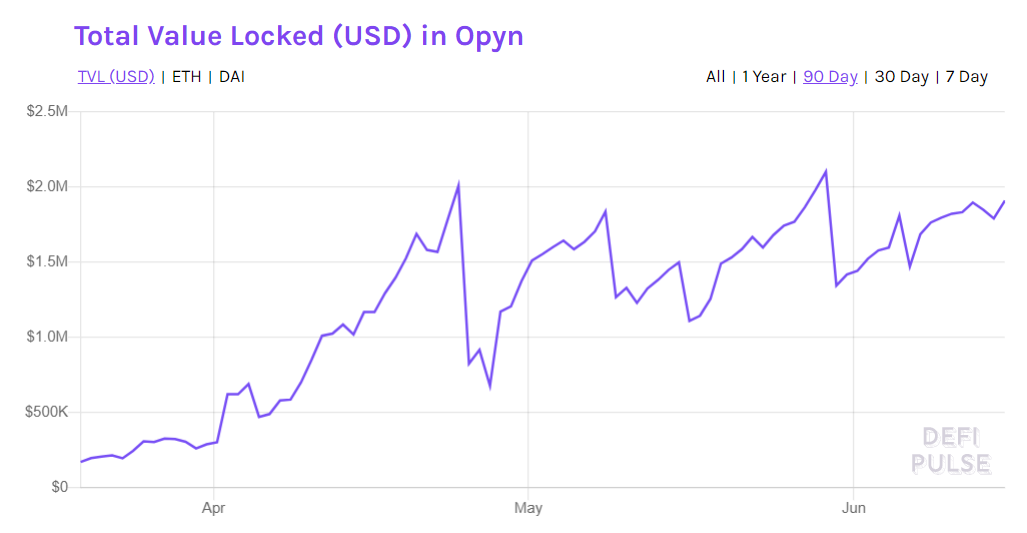

And the total value locked (TVL), as tracked by DeFiPulse, is going on an upward trend.

For the first few months that OPYN has been live on mainnet, there were only ETH put options available. But on June 12, the first OPYN call option went live on the platform. One would expect that the slope of this curve in the TVL graph might become more vertical now that call options are available.

For now, users must collateralize put oTokens with 100% USDC in the amount of the ETH strike price of that particular smart contract. Sellers of call oTokens have to lockup ETH in the vault, knowing that if price moves above the strike price they will be receiving USDC back instead of ETH when they redeem their collateral.

Different options, with various combinations of the 8 parameters listed above, are distinguished by different oTokens, and controlled by separate smart contracts. For example, to mint an ETH put option oToken with the strike price of 200 USDC, a user needs to transfer 200 USDC to the vault and initiate the process to mint the put option token. These ERC-20 oTokens are fungible, which means both the options holders and writers do not face individual counterparty risk. However, those oTokens are not fungible with oTokens that have different expiry dates, strike prices, etc. which presents a challenge to liquidity.

The OPYN model differs from options models found in traditional finance, in which margins are locked in the trading account. A clear advantage of oTokens being fully collateralized at the strike price is that the vault will never go undercollateralized. Options sellers/writers avoid the case of liquidation, such as what recently happened with the MakerDAO vaults on Black Thursday. Even when the price of the underlying cryptoasset moves against the option seller, it is impossible to be liquidated because the collateral is already stored inside the oToken smart contract created for that particular option.

Still, Uniswap is the major trading venue for oToken trading. In the Uniswap liquidity pool (LP), a classic XYK model is applied, and LP providers suffer from impermanent loss (IL) if the price of the underlying moves away from the collateral when the LP providers add both tokens into the pool. Therefore, LP providers benefit most in cases where the price of the two assets stays constant.

The potential problems above negatively affect oToken liquidity due to its almost exclusive reliance on Uniswap. The oToken writers are essentially forced to sell to harvest premiums, rather than provide long-term liquidity, because the value of all individual options must depreciate as time goes on at a rate known as theta, which is also called the time decay of options. The speed of decay accelerates as time moves closer to expiration. Therefore, LP providers are highly likely to suffer great impermanent loss in providing individual oToken liquidity. In the way that the current platform is structured, it seems that mostly Opyn themselves are the providers of this liquidity as the option to contribute one’s oTokens to the relevant Uniswap LP is not currently included in the UXUI. Of course, one could interact with the OptionsExchange contract directly via etherscan, but this is a task best left to seasoned blockchain engineers.

This characteristic threatens the growth of the entire system because if the LP is not deep enough, oTokens would be difficult to circulate. OPYN may be forced to boost the liquidity of the pool by themselves and be forced to absorb the IL in exchange for increased TVL in the protocol.

Though the birth of options is from a bilateral contract between two parties, the beauty of options in finance is dependent on the high liquidity of the secondary market. We believe the same is what the OPYN team is trying to accomplish with their model, to bootstrap the options trading and pricing market along the ETH pricing curve before potentially moving on to other highly liquid ERC-20 tokens.

OPYN’s options currently are of the American type, in which users may exercise their right to the underlying assets before expiration at their own discretion. However, the Convexity Protocol does allow for either European or American style options to be minted. Also when exercising the option, the OPYN smart contract requires the actual delivery of the underlying assets, which is called physical settlement. Like when exercising a put oToken, the option writer could choose to give up their USDC collateral and instead receive the option buyer’s ETH in return, at the strike price defined in the oToken smart contract. Due to the full collateral of the oTokens, the physical delivery is also protected upon settlement.

Some points to consider in the final analysis of Opyn. Clearly, it is a rapidly iterating platform that has had great initial success in attracting increasing notional amounts of capital to the protocol. The Opynfinance Github has clear documentation. We even noticed a recent addition for “Opyn v2 margin protocol,” both of which show the team is dedicated to improving their platform.

However, as normally an option buyer would like to hedge, insure or speculate on the movement of the underlying asset’s price, which is usually denominated in USD, he/she should be agnostic as to whether or not the counterparty may deliver the full underlying asset when exercising. Therefore, instead of physical settlement, cash settlement that covers the potential gains of the holders is likely to be adequate as well as less capital intensive. It may even not need to be 100% collateralized for the full physical delivery, which would certainly make the options creation process more efficient and flexible.

Hegic

Similar to OPYN, Hegic is an on-chain options trading protocol on Ethereum, but the model is fundamentally different. A pooled liquidity model is the key to Hegic’s way of options creation and premium distribution, which means that the counterparty for options buyers is the whole smart contract vault.

Hegic has both American calls and puts for Ethereum (ETH). Hence, it currently has two pools: one pool of DAI that serves as collateral for those who would like to mint and purchase puts, and one pool of ETH that serves as collateral for those who would like to mint and purchase calls. Those who provide liquidity to either of these pools share in the profits earned from premiums written on bespoke options created by the options buyers based on the pool assets. These liquidity providers (LPs) also share in the losses should the collateral be claimed back from the pool by in-the-money options writers.

Unlike the OPYN model, the LPs in the Hegic options model do not directly mint option tokens themselves. They are options LPs, not options writers. Thus, they cannot control the exact options that the options buyers (who decide the options terms in this case) pay premiums for. Each option written is unique and is 1) based on the price of ETH at the time of the minting and 2) based on the option writer’s selection of one of 5 times to expiry, currently 1, 7, 14, 21, or 28 days.

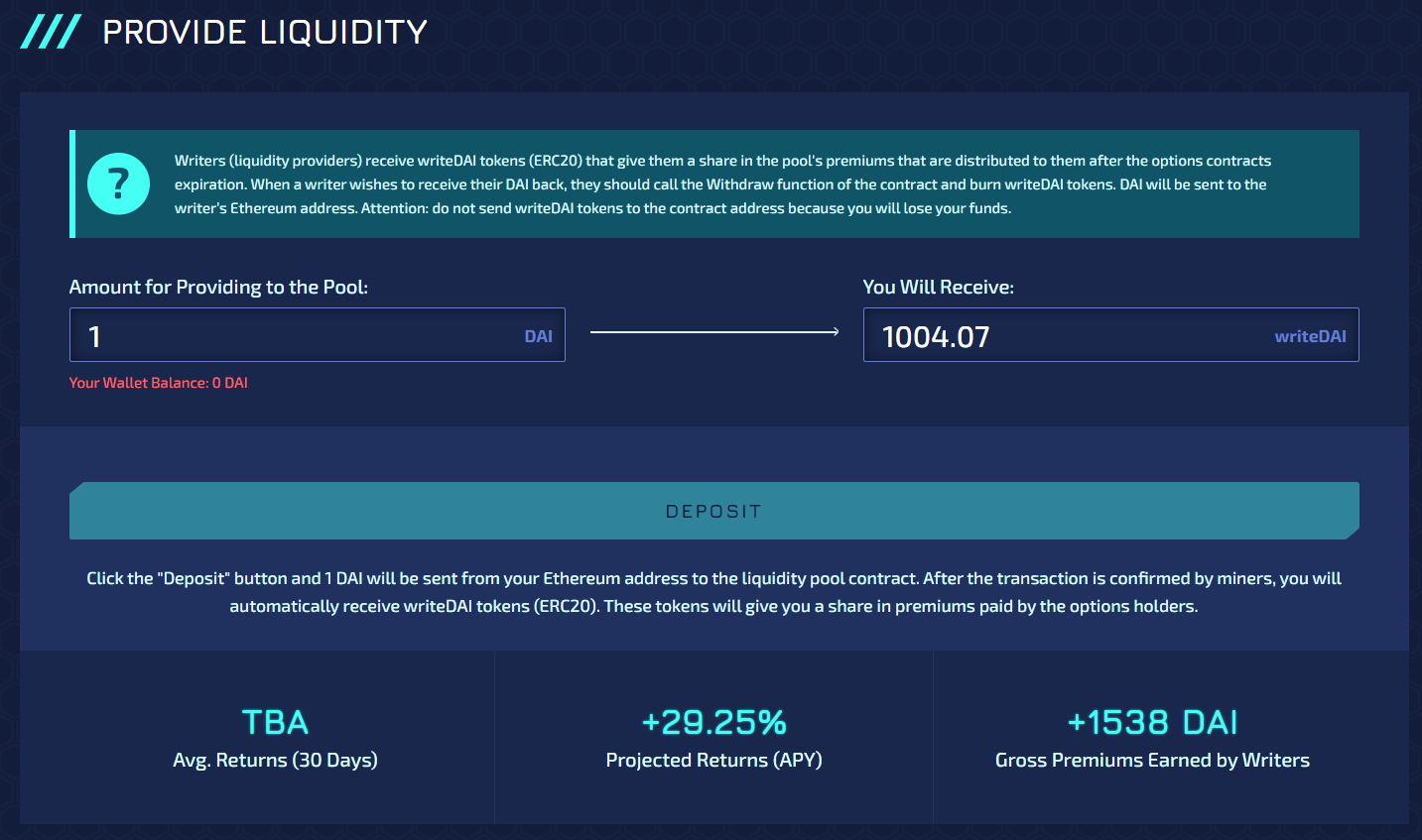

By providing assets (ETH or DAI) into a pool, like with Aave or Compound, Hegic LPs receive writeETH or writeDAI Tokens that are automatically minted and give the LP a share in the liquidity pool. Premiums and losses are distributed between all the LPs. When writers wish to receive their ETH or DAI back, they just call the Withdraw function of the smart contract, which burns their writeETH or writeDAI tokens and returns their share of the ETH or DAI in the pool at that moment.

This pooled collateral mechanism ensures that options positions are always fully collateralized. For the ETH put options, DAI in an amount equivalent to the ETH strike price in the contract will be locked for the period of time that a holder has paid for. For the ETH call options, an equivalent amount of ETH will be similarly locked. Hegic’s liquidity pools are the only counterparty to the options buyers in all transactions.

The pool LPs do not have direct control over the writing of the individual options contracts. Instead, they passively accrue premiums and losses from different options minted from their pool over time. This method is much more gas efficient than the OPYN model, where gas must be used at each of 3 or 4 steps every time an LP wants to mint an option and receive premiums, which could be as often as once per week. In the Hegic model, the LP does not have to mint options themselves, so the only time gas fees are paid is when they enter assets into the pool and when they withdraw them.

A benefit to the Hegic model is that the buyers can choose the terms of the options at their own discretion. They can create their own bespoke option by choosing option type, strike price or expiration date. As long as the Hegic liquidity pool is deep enough, this model appears more flexible than OPYN. Option buyers can buy in-the-money (ITM), out-the-money (OTM), or at-the-money (ATM) calls and puts. However, in its current state, the option price is algorithmically predetermined by Hegic. At this point, Hegic manually updates, based on historical data, the Implied Volatility Rate, which is the most important component of option pricing in the Black-Scholes formula.

For option buyers, Hegic is looking to improve their liquidity options. In Hegic Protocol v1.0, these buyers have no other choice but to exercise the contract if the price moves in a favorable direction. However, in Hegic Protocol v1.1, they will have the choice to resell their ITM option contracts back to the pool during the holding period. In the exercise of an American option or future, we call this ability cash settlement rather than “resell,” as it settles the “cash” difference, compared to the physical settlement or physical delivery, a term that is more appropriate for commodities, that is available in Hegic 1.0.

Hegic Model Advantages

There are some beauties in Hegic’s pooled model:

First, the UI is quite pleasant to operate. Though the Hegic model seems a bit complicated, a user can become an option holder or LP very easily.

Second, options buyers have more flexible choices. They can choose an option strategy that best suits their risk profile. Hegic allows users to set any strike price and choose among several selectable durations.

Third, it is a safer way of backstopping options compared to those written by an individual LP. The premiums and risks are distributed among the LPs. Because the options buyers decide the terms themselves, it is more likely that they create a product that best ameliorates their risks.

Fourth, it should attract more capital to the pools due to greater capital efficiency. By separating the role of the LP and the option writer, LPs can just sit back and let fees accrue to their investment without having to worry about performing any action on their part. In the traditional financial market, the collateral capital behind options often comes from professional institutions, using leverage to amplify returns and managing risk via sophisticated hedging mechanisms. Hegic can accommodate these whale investors while also allowing small LPs to participate in the pools to sell options, without worrying about the complications, and mutually share in the benefits and risks in the pool automatically. The pools essentially function as portfolios, with the writeTokens as shares of that fund.

Still, there are also some points that users may pay attention to:

First, Hegic options are non-transferrable and non-tradeable. Hegic’s options only exist at the contract level, which is different from OPYN’s model that tokenizes the options into standalone ERC-20 tokens. While Hegic options are more tailored to buyer needs, they cannot easily circulate on the secondary market after creation, limiting liquidity. Hegic Protocol v1.1 will introduce the “resell” function to allow users to sell the position into the pool anytime before expiration. The liquidity problems are partially solved by this mechanism.

**Second, users must actively monitor the distribution of their premiums. **Despite the audit of Hegic’s code, there were some coding errors back in April that resulted in nearly $30,000 in ETH locked forever. However, in May, there was another exploit due to a fundamental design flaw in the premium distribution. The instant distribution and withdrawal of collateral along with premiums earned caused an inequality of risks and returns between early and later pool entrants. Early pool providers may accrue the premiums, remove their liquidity and their whole associated premium gains at any time, even before the options in the pool matured, leaving all the risks to the later pool entrants.

In Hegic V1.1, option premiums will be distributed after options expiration. Liquidity will be locked for 14 days from the date of the last deposit. These operations hopefully rectify the former exploitation cases. Still, new exploits may always arise. As long as the premiums are allocated to the pool at one time, the LP risk and returns are unbalanced. A model that distributes on a time scale as options move closer to expiration may perform better.

Third, the Hegic options pricing model may be flawed. It is said that the key to option pricing is to determine the implied volatility rate, according to the classic Black-Scholes pricing model. Trading options is essentially trading volatilities. The famous VIX, often referred to as the fear index, is derived from the expected market volatility based on S&P 500 index options. The option prices in Hegic are derived from skew.com data and then the implied volatility (IV) is manually updated, rather than dynamically priced in real-time by the market, in the Hegic protocol. Therefore, arbitrage opportunities between Hegic and other options venues could arise, but this is currently not an issue. Due to the various methods one could automate IV calculations, options pricing is the most challenging aspect for all the emerging decentralized options platforms. In other words, IV issues are not unique to Hegic.

**Fourth, Hegic options may have trouble bootstrapping liquidity. **Hegic options are not tokenized and can only be exercised (or resold as in V1.1). Thus, there will not be an active secondary market after the creation of options. If one believes in the trope that the beauty of options only shines in a highly liquid market, due to the gaming that occurs around the constantly shifting expectations of IV, then Hegic has yet to provide such possibilities.

Moreover, the volume of the options is largely dependent on the size of the respective pool. To keep pools flexible enough for withdrawals, there must be some proportion of each pool reserved for liquidity. Therefore, it is a challenge to attract the number of active participants needed for both the supply and demand sides, while the crypto options market is newly born.

Fifth, hedging risk for LPs will be difficult in the nascent decentralized options market. In the traditional financial market, those who backstop options products are mostly professionals who have access to a variety of means to hedge against the potentially unlimited risks associated with options products. However, the liquidity providers of Hegic options are pooled together, jointly acting as the counterparty to all the valid option contracts written from the pool, with different strike prices and expiration dates. Hedging those risks would be extremely difficult for Hegic LPs.

Nevertheless, Hegic opens a new door for decentralized options platforms, one which is not seen in the traditional financial world. There is great potential here.

ACO

ACO is a decentralized non-custodial options protocol built on top of Ethereum. It launched in May 2020 by Auctus.

The decentralized options mechanisms on ACO are similar to OPYN. The options are tokenized into ERC-20 compliant ACO tokens, each with their own smart contract and unique programmatic ticker symbol. For example, a token named ACO ETH-200USDC-C-26JUN20–0800UTC represents an options token made with the ACO protocol with ETH as the underlying asset, with a strike price of 200 USDC, a call C not a put P, with an expiration date of 26 June 2020 at 8:00 UTC.

These tokens are American-style options, which just means that the holder can exercise the option at any time before its expiration date. In order to earn premiums, LPs must fully collateralize option contracts by locking relative amounts of ETH or USDC into calls or puts, respectively. As with Opyn, the LP is tasked with the gas costs and active maintenance of writing these options, which are standardized by the protocol rather than customized by the user.

The exercise of ACO options is not automatic and the settlement is “physical” since the underlying asset is transferred and delivered. Interestingly, ACO also has Flash Exercise functions by integrating Uniswap V2 Flash Swaps, where the net difference between the Uniswap price and the strike price would be received. In total, ACO is a nice functional platform that seems a little more fleshed out than OPYN. But as we’ve seen recently with Compound and decentralized lending platforms, the battle will be to bootstrap liquidity.

Primitive Finance

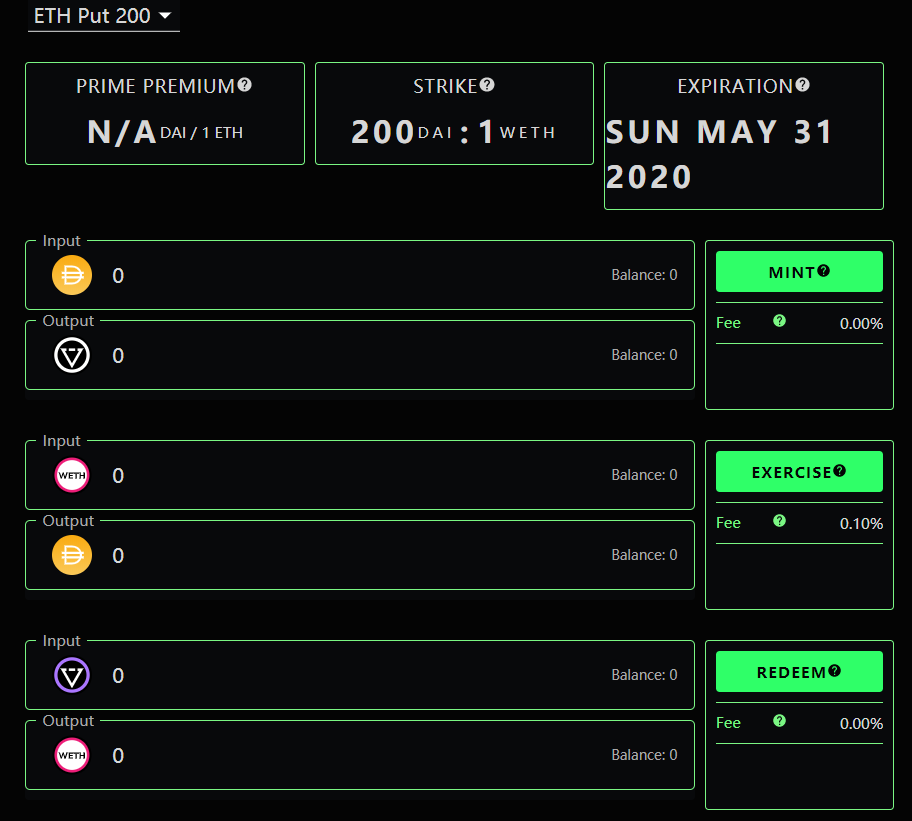

Primitive is a permissionless protocol for creating option derivatives on Ethereum. It is very early in its development cycle. The platform went live in early May 2020, the first trial being with a pool trading an ETH Short Put strategy with a short-term expiry. The official launch of the protocol is yet to come.

According to their official website, like OPYN and ACO, a Primitive option comes in the form of an ERC-20 token, called Prime. But Primitive has a different model than the previous platforms analyzed here by having a four token design:

Primitive has designed its options smart contracts to pool liquidity. That liquidity comes from options writers who mint Primes. Anyone who writes options (sells to open) can deposit in the pool. Redeem tokens are also generated and are used to withdraw the strike assets from exercised Primes (options). Therefore, both the options products and the pools are tokenized.

Primitive plans for the options to be traded on Primitive’s Automated Market Maker (PAMM), which is designed to pool liquidity and act as a medium of exchange. Think of it as a Uniswap liquidity pool, but specially tailored for options liquidity. For the liquidity pool (LP) participants, a Primitive Underlying Liquidity Provider (PULP) token is minted to LPs who provide underlying tokens to the PAMM. This is a token for LPs to track their ownership of the pool collateral. They burn them when they wish to withdraw their tokens and premiums that have been earned, which is proportional to their ownership of the pool.

The initial liquidity for these pools will have to be bootstrapped most likely through Primitive itself, while other users may be well incentivized to participate in the pool. The protocol is still very much in its formative stages, so it’s hard to tell.

Primitive applies a simplified model for options pricing, especially in regards to time value. What is interesting is that Primitive uses “demand” as a proxy for the IV value, which is the “utilization” of the pool. It plans to derive IV from the utilization of the liquidity pool and apply it to options pricing. While this is an interesting and novel concept, we have seen how easily “yield farmers” have been able to game a similar metric in the Compound protocol during the early phases of COMP liquidity mining. Ultimately, Primitive plans to have the PrimeOracle aggregate some volatility metric and store it in the smart contract, bringing an IV metric from offline to on-chain and use it in this contract.

Primitive is a bright new star in the decentralized options landscape, with many brand-new and interesting features being experimented with in the alpha stage. However, at this stage, the security audit has yet to be completed. We’re looking forward to the official launch of the Primitive protocol.

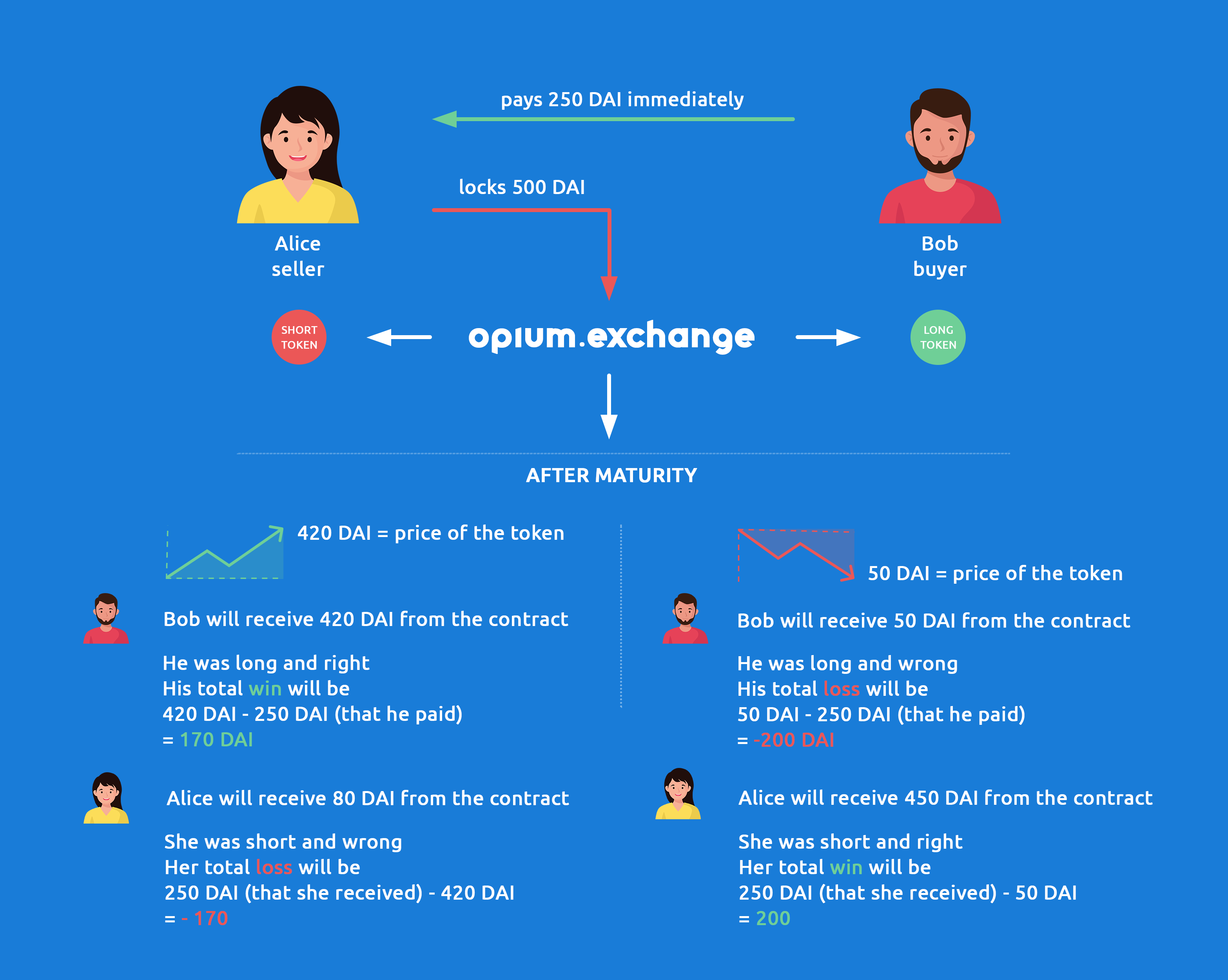

Opium

Opium is building a derivative protocol that has broader dreams, not just limited to options. According to their documents, “the Opium protocol is a universal protocol to create, settle, and trade virtually all derivatives and financial instruments in a professional and trustless way. It allows anyone to build custom exchange-traded products on top of the Ethereum blockchain.”

Unlike the other platforms mentioned here, they’ve even created their own Opium token standard. All positions on the Opium Network are created in the form of an ERC-721o token, which is a self-proclaimed “Composable Multiclass Fungible Token Standard.” It is a combination of the ERC-20 and ERC-721 token standards with some extra functionalities thrown on top to make the standard especially suitable for trading financial instruments, as opposed to the generic ERC-20 standard.

Because financial instruments usually are combined and managed as portfolios, Opium created this standard to make it easier to wrap several tokens into a portfolio that is represented by one token.

Users can trade multiple positions at the same time and compose, decompose and recompose Opium portfolio tokens, which are also based on the ERC-721o standard. The protocol even stretches into the scope of contracts for almost anything, like sports gambling or gaming.

The Opium Network aims to be built with the following 6 qualities.

The trading mechanism in Opium Network is a crucial one, where multiple assets may be swapped at the same time. For rebalancing a portfolio, this method could also significantly save on gas costs. Many tokens can be wrapped into one and moved to a destination in a single transaction and then unwrapped. Opium believes that the orders should be matched off-chain rather than on-chain, as they are computationally heavy and impractical because of block producing times. For example, a platform user states the amount of an Opium token and amount of an ERC-20 token he is willing to provide, and the different ones he wants to receive. Orders will be matched in the relayer by traders, brokers, or other players.

While the Opium Core contract is connected to the oracle and derivative registries and minter, its role is to execute the logic of receiving and paying off the margins to and from users.

The Opium Exchange began in May 2020, and it claims to be the first professional derivatives exchange where users may list their own decentralized derivatives. They use the traditional order book to match the orders, rather than a pooled liquidity model. As it is just getting started, the orders are not so deep and most of the liquidity is provided by the Opium team.

There are some interesting products launched on the exchange recently.

Apart from their own version of standard ETH futures, more interestingly, Opium has Options on Gas price in ETH, which allows users to hedge the Ethereum gas price.

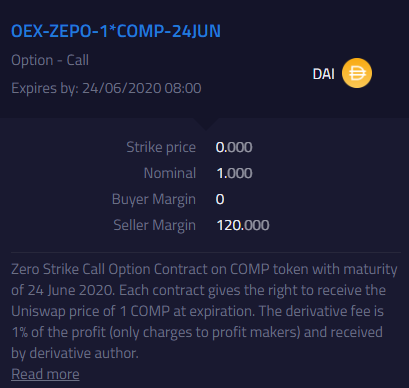

In June, before COMP was listed on Uniswap, the Opium Exchange launched OEX-ZEPO-1*COMP, which is a European style zero strike call option on COMP with the strike price set at zero, replicating the asset of Compound’s governance token. These kinds of unique derivatives provide a decentralized method to make a futures market for unlisted tokens.

This innovation is used to create a pre-market and is not often seen, even in the traditional financial market. When the expiration date arrives, the holder of this COMP ZEPO will definitely exercise it, so it is somehow similar to owning the underlying asset. But right now the seller’s margin is fixed, as in the example below which is 120 DAI per ZEPO, which caps the possible profit of any ZEPO buyer. Even though COMP might trade at $200 or $300 on July 1, the owner of this asset will only receive 120 DAI. Opium is launching a number of zero strike options with different seller margins.

The standard ETH options available on the Opium Exchange have different features from the other platforms compared in this article.

First, Opium offers partially collateralized options. Compared with the 100% collateral requirements as margin on the strike assets in Hegic, OPYN, and AOC, Opium currently has only a 33% margin requirement for writers that use DAI. This practice will be familiar to those who trade options in the traditional financial market, providing an additional source of leverage to option sellers. However, the margin is fixed in the contract, rather than dynamically changing according to the price of the underlying assets, which is how most decentralized platforms currently operate. This difference in margin calculation may give rise to price anomalies that can be arbitraged if it is less liquid on the Opium Exchange.

Second, a variety of assets are eligible for margin. The collateral provided to margin accounts can be in stablecoins or any ERC-20 tokens, allowing traders to speculate on the future value of Opium products with more flexibility. We can call it a multi-coin margin function.

Third, Opium derivatives are European-style and cash-settled. These characteristics mean that the options can only be exercised at expiration and are not physically delivered. The options writer just pays any net profit due to the options holder at expiration in either stablecoins or any ERC-20 tokens.

As intended, these characteristics may provide some advanced opportunities for exotic trading strategies based on leverage and options liquidity.

The Opium protocol seems to have a big dream over the whole derivative market, not just options, and has the potential to create some pretty complex structured products based on portfolios of derivatives, with the ability to compose, decompose and recompose tokens on the fly. In summary, Opium is working on some eye-opening innovative products and is worth keeping tabs on.

Pods

Pods is a decentralized non-custodial options protocol built on Ethereum, where users can participate as sellers or buyers of either puts or calls. The team has previous DeFi options experience. Some previously worked for Mainframe and launched ohmydai in November 2019. Pods seems to be an expansion of that initial concept born during HackMoney*, *a 30-day virtual DeFi hackathon event hosted by ETHGlobal, and a variety of top-notch DeFi outfits, earlier this year.

Pods options are American style with physical settlement, with 100% collateralization of the strike assets, leaving no exposure to price oracles and liquidation systems.

Pods options are quite similar to the OPYN model and tokenized into an ERC-20 primitive called odTokens. The calls and puts are appropriately called codTokens and podTokens and can be transacted on Uniswap for liquidity.

What makes Pods interesting is that it intends to move a step further with DeFi composability. Since providing liquidity for options minting is a choice between the return you would get from minting and the return you would get from staking that collateral on a money market protocol, Pods has made that choice much easier. By integrating the aTokens of Aave as collateral on its testnet, Pods uses Money Legos to let you earn both. Eliminating this choice should theoretically increase the incentive to write options and be more capital efficient when selling put options. In short, instead of locking up USDC or DAI for the duration of the option when minting put options tokens, Pods allows for locking up an interest-bearing token (such as aUSDC) inside an option’s contract as collateral.

The first trial was made for two different puts with two different underlying assets, WBTC and UMA’s ETHBTC. Pods is still on testnet and as yet unaudited. Still, the team has begun strong and we look forward to seeing some more interesting integrations on Pods as the project develops.

Synthetix

No comprehensive overview of emerging DeFi protocols would be complete without at least some mention of Synthetix. As a platform focused on creating any type of synthetic asset, options have of course been on the project’s radar since the beginning. Earlier this year, the project announced its plans to launch paramutuel binary options later this year, announcing Q3 as their target in the roadmap for 2020. On 23rd June, on [Synthetix Community Governance Call](http://Synthetix Community Governance Call), Synthetics released a short introduction on the prototype of what the Synthetic options platform looks like.

In the creation of options Synths in Synthetix, the mechanism will be quite different from all the platforms mentioned above. With adequate collateral value of staked SNX tokens that in turn provide a deeply liquid platform-wide debt pool, option Synths tokens can be minted directly. Here the underlying asset will be the Synthetix staker’s debt and the synthetic options may track the value of other underlying assets according to Chainlink oracles. The proposed system is explained in detail in SIP-53 but we have yet to see any further announcement from CEO Kain Warwick on these derivatives of derivatives.

As with all DeFi innovations these days, the trading of these synths will be reliant on system liquidity. Synthetix Exchange could be the ideal place to trade these innovative options products as Uniswap would likely encounter numerous impermanent loss problems. However, synths are designed to track rather than lead value and there are already synths that track or inversely track the prices of underlying assets on the platform. The strategies that could be employed with the accumulation of these hedging tools will be quite interesting. We’ll just have to wait and see what the extremely capable Synthetix team and community come up with when they finally do get around to focusing on the decentralized options opportunity.

FinNexus

FinNexus is building an open finance protocol to power hybrid marketplaces that trade both decentralized and traditional financial products. FinNexus has already launched the first real-world tokenization product called UM1S, together with the process of ICTO, while the decentralized option protocol V1 is due for release in Q3 this year according to the 2020 roadmap.

Different from the previously listed platforms, the first version will be launched on Wanchain Blockchain, which provides much faster transactions and lower gas fees. Also, it will comprehensively integrate Wanchain’s cross-chain mechanism to allow for options based on BTC and other crypto assets. The next step is to simultaneously run the options protocols on Wanchain and Ethereum together.

Though the official release of the model is yet to come, users may find some unique features from the V1 code available at our FinNexus Github portal.

First, the options are tokenized and transferable, after minting. The options will be the European type with automatic cash settlement upon maturity. Only the difference will be settled in the collateral currency upon maturity, when the exercise will be automatically done.

Second, the underlying assets and collaterals will be whitelisted and not limited to just ETH or a stablecoin. FinNexus will subsequently integrate cross-chain assets that are already integrated with Wanchain — BTC, ETH, EOS, LINK and more — into the various collateral pools for minting options.

Third, the FinNexus decentralized options platform will use a dynamic margin model as the collateral for writing options. As the price moves further out-of-the-money for the options, less margin will be needed and more options can be minted by the same amount of collateral; and vice versa for in-the-money options. If the margin fails to get to the required level, the liquidation process will be activated. Liquidators will be heavily incentivized.

Fourth, the FinNexus multi-coin collateral mechanism will provide more flexibility to options writers. There will be a choice of baskets of assets to be collateralized as the margin. In the first version, WAN and FNX will be the main collateralized currency for margin on Wanchain.

Last but not least, FNX liquidity mining will begin soon after launch. Options writers will be incentivized in a number of ways, including the distribution of FNX tokens as rewards in regards to minting and trading volumes on the FinNexus options platform once it goes live.

Moreover, in the future version, FinNexus is planning for a collective pooled model, using FNX as the major collateralized asset, to mint both call and put options, with multiple underlying assets. The pool will be acting as both the minting collateral pool and liquidity pool, for the creation and transaction of options. The holders of pool will be granted with pool share tokens. Risks and rewards will be shared among the pool participants.

Conclusion

As DeFi has now burst onto the entire crypto scene, it is worth taking a look at what protocols might explode in usage as the DeFi Summer of 2020 continues. The previous decentralized options platforms all use different approaches and are at various stages of development.

We at FinNexus believe so much in the future of decentralized options products and are extremely excited to throw our hat into this ring.

Until then!

About FinNexus

FinNexus is the open finance protocol built on the blockchain. It is a hub for connecting different decentralized ledgers to each other and users, and also for connecting with traditional finance applications. The first iteration of FinNexus will be a marketplace for hybrid decentralized/traditional financial products.

***Telegram| Twitter | Newsletter | Whitepaper | Facebook | Linkedin***