FinNexus Blog

FinNexus Blog

FinNexus Options Comes to Wanchain

Noah Maizels — November 8th 2020

Unique DeFi Dual Dapp goes live on both Ethereum and Wanchain today at UTC 14:00.

After a successful launch on Ethereum last week on November 4th, FinNexus’ unique approach to decentralized options will now debut on Wanchain. Remember that the long-term vision of FinNexus is to deliver a suite of DeFi solutions across many blockchains, not just Ethereum. Wanchain is the 2nd blockchain you can find FinNexus Options on. More are planned in the future.

Announcement: The FinNexus Options platform will go live on Wanchain today Monday, November 9th at UTC 14:00.

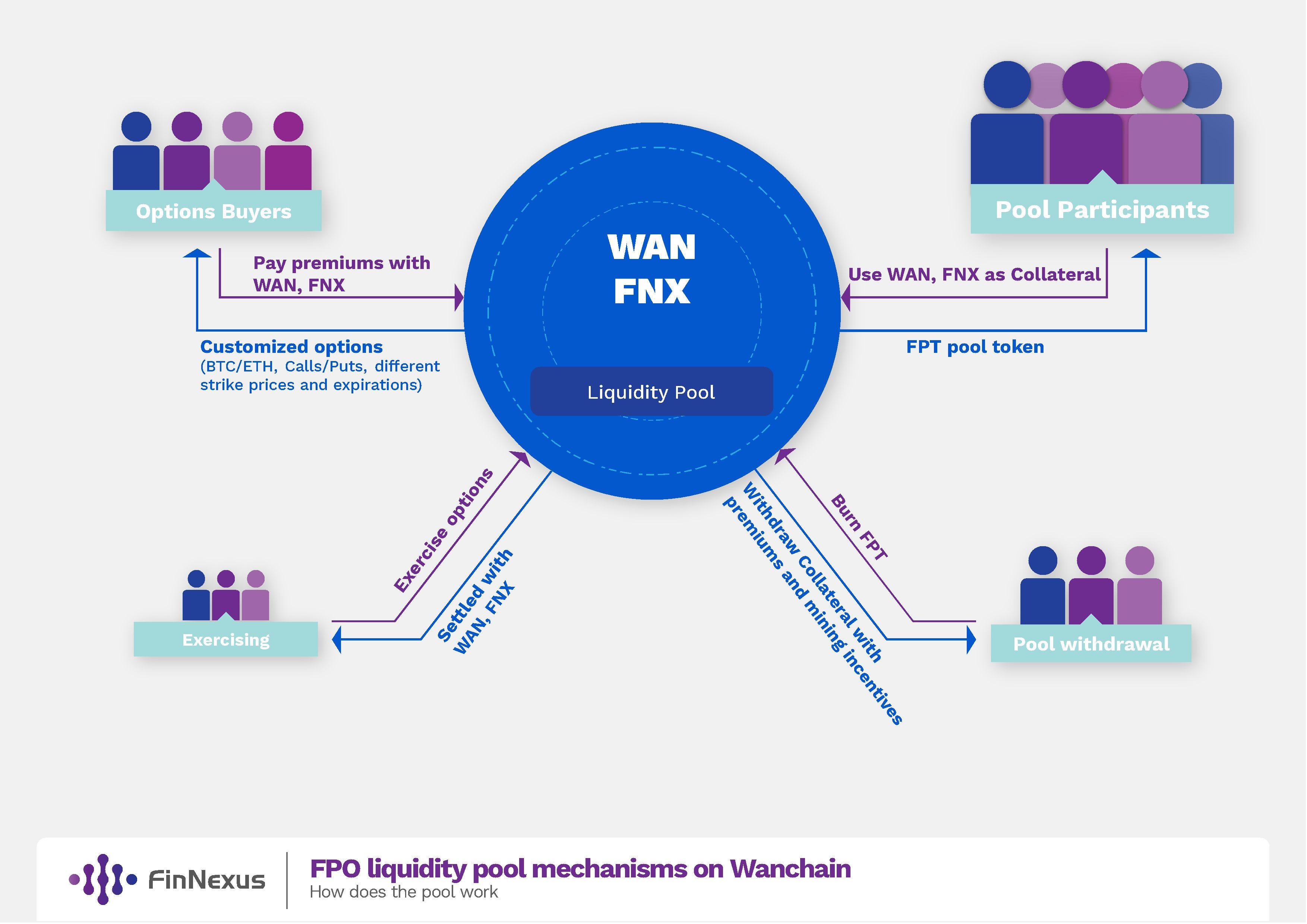

The basic model on Wanchain works the same as the MASP mechanism we used for our WildNet experiment on Ethereum. You can use your WAN coins and FNX WRC20 tokens to contribute to a monolithic collateral pool and earn more FNX WRC20 tokens! The liquidity pool on Wanchain for the FinNexus Protocol for Options (FPO) v1.0 is essentially the same as what we will simultaneously have available on Ethereum. We’ll talk about the advantages of operating a DeFi options Dapp on Wanchain and the differences between FPO on Ethereum and FPO on Wanchain below.

The Basics of Using FinNexus Options Platform

Using options.finnexus.io is simple, although it might seem complicated at first if you’re unfamiliar with options. But it all starts with interacting with one of two Wanchain wallets. Just like you need Metamask when you’re interacting with our smart contracts on Ethereum, if you’re interacting with our smart contracts on Wanchain, you need to use either Wanmask or the Wanchain light wallet available here. Just hop in our Telegram if you have any issues!

The mechanism of using FPO is grounded in DeFi principles. If you’re risk-averse but want to earn a return on your FNX WRC20 tokens or WAN coins, just stake them into the FPO collateral pool on Wanchain to earn your portion of transaction fees from people that buy options from the pool. From today and at least for the next two weeks, you will also be mining both FNX WRC20 tokens and WAN coins for every block you have contributed capital in the pool. Stay tuned for more info about the first liquidity mining incentive ever offered on Wanchain!

If you are a risk tolerant token holder, you can use your WAN coins or FNX WRC20 tokens to purchase options exposure on the price movement of either bitcoin (BTC) or ether (ETH). That options exposure is backed by the collateral held by the on-chain liquidity pool.

Advantages of FPO on Wanchain

A lot of people ask us why we want to operate our DeFi options platform on two different platforms. While the DeFi community and lion’s share of liquidity is obviously on Ethereum, we like Wanchain for a lot more reasons besides the fact that they are our lead investor.

Here are just a few great reasons to use FPO on Wanchain:

-

Cheap gas fees

-

Fast transactions

-

Native cross-chain integrations that make it easy to trustlessly move assets between chains

-

Dedicated WAN fans

FinNexus was born from the Wanchain community and it is time we gave back to that wonderful community!

Ethereum FPO vs. Wanchain FPO

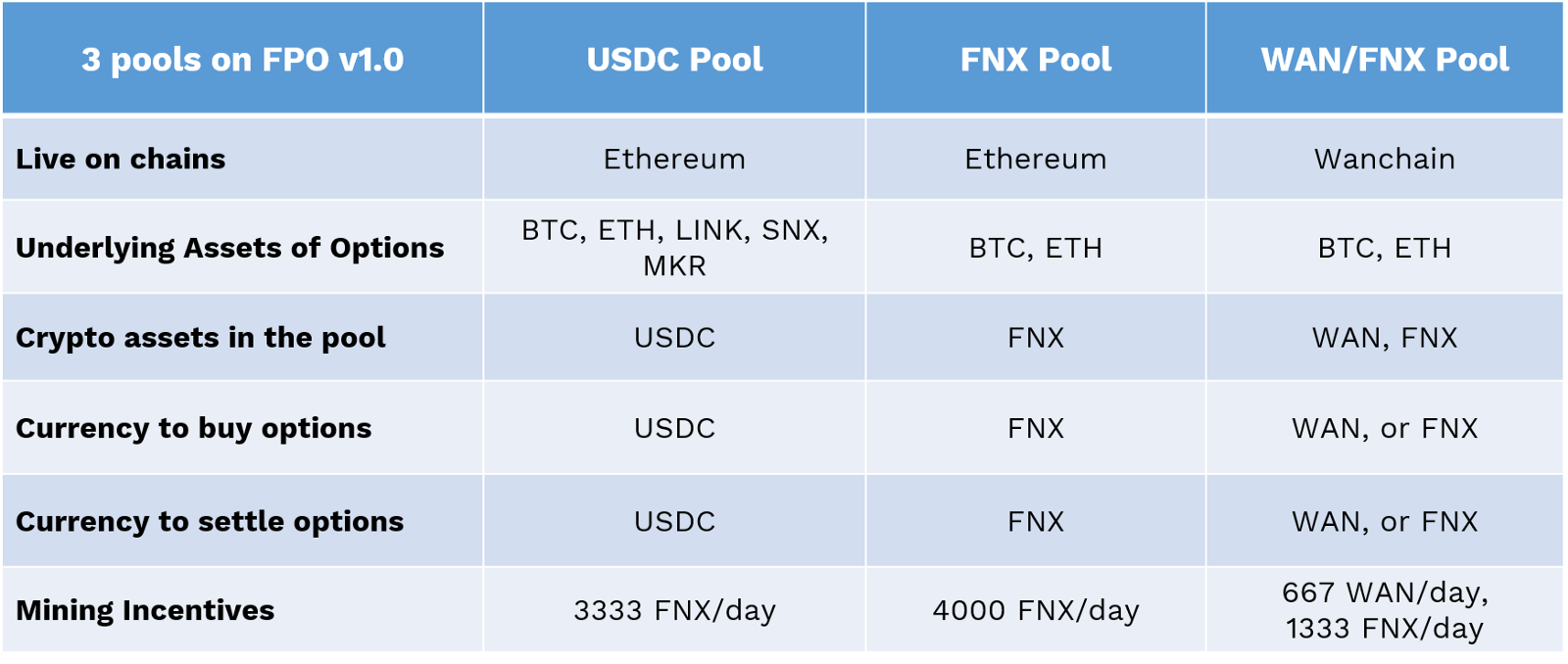

The primary difference between the Wanchain and Ethereum FPO versions is that the liquidity pool of FPO on Wanchain contains two different collateral types rather than just one — WAN and FNX. This is of course is in contrast to the Ethereum version of FPO, where there are instead two separate pools with two different collateral types, the USDC pool and the ERC20 FNX pool.

This is great for Wanchain FPO early liquidity providers since by depositing either FNX or WAN as a liquidity provider, it allows you to earn both FNX and WAN at the same time during the thirty day early liquidity provider incentives program!

There are a few other advantages related to the Wanchain platform itself. Due to Wanchain’s faster and cheaper transactions, the cost of a Wanchain based FPO transaction is a small fraction of the same transaction on Ethereum. Since it takes only a fraction of the time for the transaction to confirm, the user experience on Wanchain FPO should be much more pleasant. In addition, as the percentage of the transaction will be a much lower portion of the transaction cost, even minnows can participate in the BTC and ETH bull run to come!

Here is an overview of the current liquidity mining programs being offered by FinNexus on both Ethereum and Wanchain.

WAN mining incentives are expected to last for 15 days, and FNX mining incentives are expected to last for 30 days, after its launch. Further incentives will be announced before the end of each period.

The FinNexus team is incredibly excited to be the first peer-to-pool options platform to offer its protocol on two separate blockchains. We firmly believe that the next wave of important DeFi building blocks will be firmly centered around decentralized options. We think that the only solution that offers true innovation in this regard is the peer-to-pool options model.

Try it today and let us know what you think!