FinNexus Blog

FinNexus Blog

FPO v1.0 Adds New Assets to the Liquidity Pool

Ryan Tian — September 16th 2020

In addition to FNX, FPO v1.0 will accept ETH and USDC in the liquidity pool.

(On the official release on Ethereum since 4th Oct. 2020, FPO v1.0 changes to two pools with $FNX and $USDC as the single asset respectively. Therefore, this article may not apply to FPO on Ethereum. But it still applies to the model on Wanchain, with $WAN and $FNX as acceptable assets in the pool)

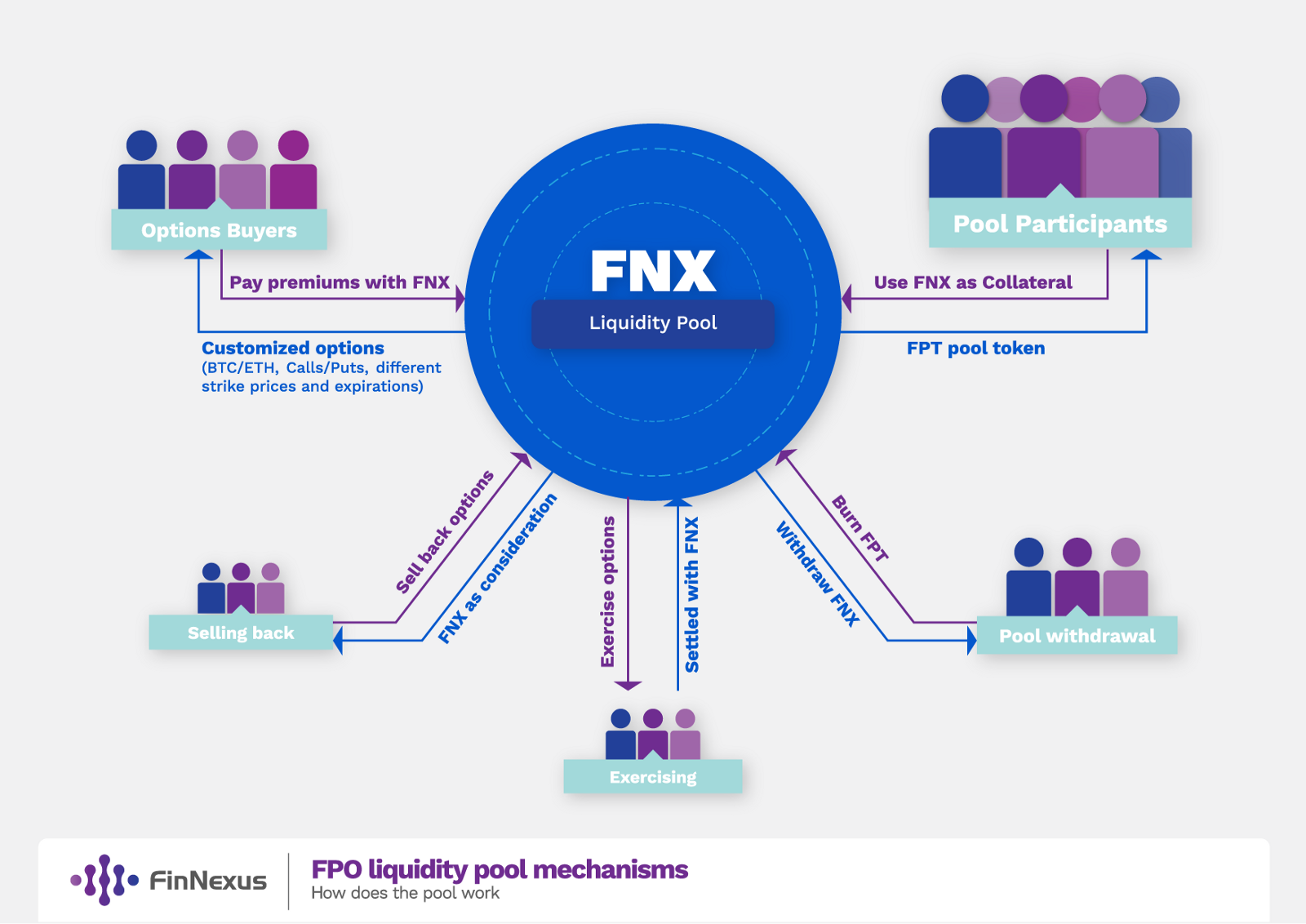

When we first introduced FPO v1.0 MASP (Multi-Asset Single-Pool Options) several weeks ago we described how a single liquidity pool powered by our FNX token would allow for the creation of more efficient markets with a wider variety of option types and reduced risk to options writers. Our monlithic pool model is different than the other peer-to-pool options model of Hegic, which just raised over 30,000 ETH in an innovative Initial Bond Curve Offering (IBCO) this past week. Rather than have each pool driven by their own single asset, as Hegic v888 plans to do with WBTC and ETH respectively, we believe that FinNexus’ MASP concept is more capital efficient and user friendly.

That original model was based on a single liquidity pool composed entirely of the FNX token. By using the value of FNX as collateral and employing reliable on-chain data feeds, FPO v1.0 will allow for the creation of options based on any imaginable type of asset with low risk to options writers. While putting the finishing touches on the MASP model, which is now running on testnets for both Ethereum and Wanchain, we realized that we could and would need to accept more types of collateral into our monolithic liquidity pool. Our goal, obviously, is to rapidly scale the Assets Under Protocol (AUP) as safely and securely as possible.

With that goal in mind, we are happy to announce the addition of ETH and USDC to accompany FNX as accepted collateral for the world’s first MASP peer-to-pool options platform.

Why Did We Add These Assets?

Under the new model, participants may contribute ETH, USDC, or FNX to the liquidity pool, and FPT (FinNexus Pool Tokens) are transferred back as a record of your pro-rata ownership share of the pool. ETH, USDC, and FNX liquidity providers are all eligible to claim FNX rewards.

Options buyers may purchase options using ETH, USDC, or FNX. When selling back into the pool or exercising options, users will get a basket of tokens that reflects the current composition of these assets (ETH/USDC/FNX) in the pool.

In later upgrades to the protocol, FinNexus is exploring the option of integrating a swap function so that users may select the desired cryptocurrencies they want to receive from the pool. If you would like to receive all FNX, you can. But this feature would be added later.

Due to differences in the liquidity and volatility of ETH, USDC, and FNX, the minimum collateral utilization ratio (MCUR) for each asset is different. A weighted average MCUR will decide the maximum value of options able to be issued by the pool. The MCUR for ETH, USDC, and FNX is set to be different, 150%, 120%, and 500% respectively, according to the liquidity, volatility, and market acceptance of these different cryptoassets. These numbers are merely a starting point. The MCUR will be subject to experimentation during the early phases of the protocol so that we might find the optimal ratio for each that maximizes the value of the FNX token while also allowing for healthy growth in AUP. However, these differences in MCUR figures are not related to the benefits of the pool participants; in other words, pool participants with the same inputs in USD will have the same amount of pool shares, no matter what cryptocurrencies they used to jump in the pool.

The potential for collaterals accepted into the pool is unlimited. In the future, FPO may accept any ERC-20 tokens (or WRC-20 tokens on Wanchain) like WBTC, DAI, or YFI in the pool. Should we integrate a transaction function from Uniswap or other AMM dexes, users may freely choose whatever tokens they desire to contribute to the pool or receive as payment from the pool.

What’s more, as mentioned in the tokenomics, 70% of the FNX token reserves (actually more like 75% due to our early token burns) are now allocated for community rewards and DAO building. FinNexus will migrate to decentralized on-chain governance step by step. Eventually, FinNexus will be governed and upgraded by sole decree of the FNX token holders. FNX holders will have the right to create proposals and vote for the essentials and parameters of the FPO, including acceptable underlying assets, the addition or removal of token types in the pool, the MCUR of each asset, and more.

Old v. New FPO v1.0 Design

Let’s take a look at what our initial design was compared to the tweaks we’ve just introduced to the MASP model.

The key features of the OLD model were:

FNX is the sole collateral powering the liquidity pool.

Users can only use FNX to buy options.

Options are traded and exercised only in FNX.

Issues With This Design:

After careful consideration and feedback from our community and advisors, we have come to realize that there are a number of issues with this model which must be addressed:

How to guarantee sufficient liquidity?

Pool liquidity would not be deep enough with FNX as the sole collateral, which would make the pool value and collateral ratio vulnerable to price slippage for large transactions.

How to ensure consistent growth in FPO v1.0’s Total Value Locked?

Given the relatively small size of FNX’s current market cap, limiting participants to only using FNX may hold back the growth of AUP or total value locked (TVL) in FPO v1.0. We have noticed by observing the TVL leaderboard on DeFi Pulse, that the valuation of DeFi tokens is highly correlated with their TVL. Therefore, constraining the TVL growth of FPO v1.0 ultimately and somewhat counter-intuitively limits the success of the FNX token itself. By maintaining a deep liquidity pool, we can ensure that any size options exposure can be written.

How to properly diversify the collateral assets in the liquidity pool?

ETH and USDC are widely used and trusted assets with large market capitalizations. The addition of these two uncorrelated assets greatly lowers the risk profile of the liquidity pool compared to a pool composed solely of FNX tokens.

How to maximize participation in the protocol?

FinNexus’s goal is to be at the forefront of the decentralized options market. Forcing participants to use FNX may prevent many users from participating on the platform. We want FPO v1.0 to be open to all DeFi users, not only to FNX token holders. By including ETH and USDC, users will have more flexible choices for trading options, participating in the liquidity pool, and mining FNX.

In light of these issues, we are modifying the FPO v1.0 Ethereum model to include USDC and ETH in addition to FNX. The Wanchain version will not include this upgrade at this time.

FPO v1 .0 with the multi-asset collateral upgrade we have described above is currently live on the Ethereum Rinkeby testnet and in the process of public testing. We have been operating a bug bounty program since early September, which you can learn more about in this article. We encourage anyone and everyone with the ability to participate in the public testing process to aid us in securing the protocol. We have set aside 10,0000 USD in FNX as rewards for debug bounty (with no limit for critical bugs). We encourage interested and able parties to lend a hand.

To learn more about FinNexus, our team, our community, and our vision, please join us in our Telegram chat room and follow us on Twitter.

Stay tuned for more to come….

FinNexus is building a suite of open finance protocol clusters that will power hybrid marketplaces trading both decentralized and traditional financial products. The headline product to be released is a fully decentralized bitcoin (and other cryptocurrencies) options model that will live on both Wanchain and Ethereum.

***Whitepaper | Telegram | Twitter | Linkedin | Facebook| Discord***