FinNexus Blog

FinNexus Blog

Protecting and Appreciating Crypto Wealth With Options: A How-To Guide With FinNexus Options - Part 1

Ryan Tian — February 5th 2021

What Is an Option?

An option is essentially a right that can be exercised in the future. In order to acquire such a right, the buyer pays a sum and the consideration is called the risk premium. Normally, the right can be the choice to buy or sell an asset at a predetermined price.

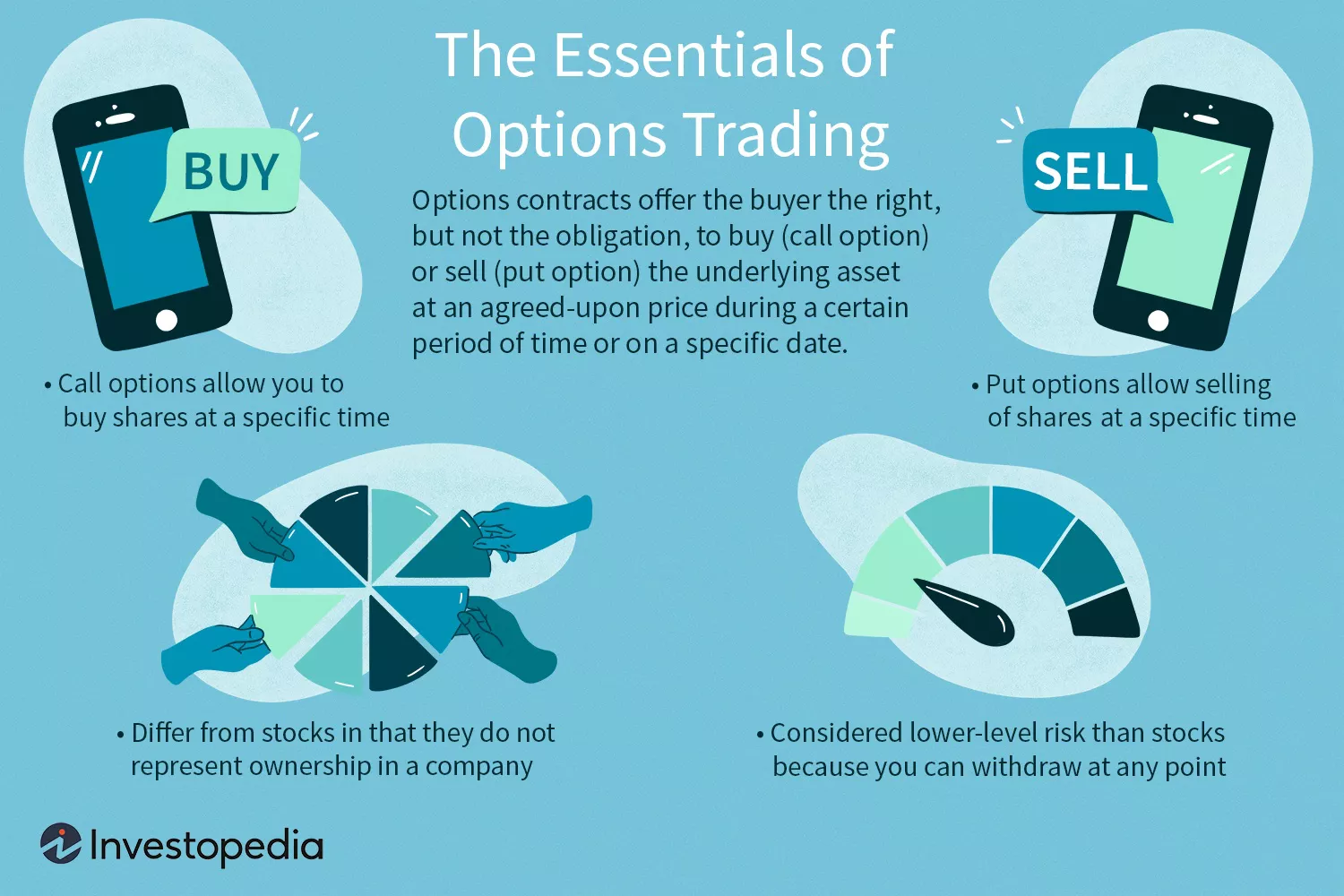

In financial terms, an option is a binding contract that allows one party - the buyer - to sell or buy an underlying asset - goods, stocks, indexes, etc. - at a predetermined price within a set time frame. As the buyer of an option contract, he/she has the right, but not the obligation, to buy or sell the underlying asset.

Let us look at a simple example. A fruit store wants to buy 500 kg of apples from an orchard owner, but the apples are not ripe yet and they will not be until August. The fruit store worries about a potential rise in the price since drought is ongoing. Therefore, the store reaches an agreement with the orchard owner to purchase the apples at the price of $4/kg in August - but it does not have to do so if there is some cheaper price on the market. In order to have this right, the fruit store pays the orchard owner $100 as compensation.

The contract above is a typical option. It is called a plain vanilla call option.

(A call option gives the holder the right to buy a stock and a put option gives the holder the right to sell a stock.)

The Difference Between Options and Futures.

Many have heard of financial instrument terms like options and futures. There are some similarities between the two. Both are financial derivative, whose value is reliant upon underlying assets. They are also both bilateral contracts, with buying (longing) and selling (shorting) parties who can trade them in financial markets. Last but not least, they both can be used as a protective strategy or provide leverages to traders.

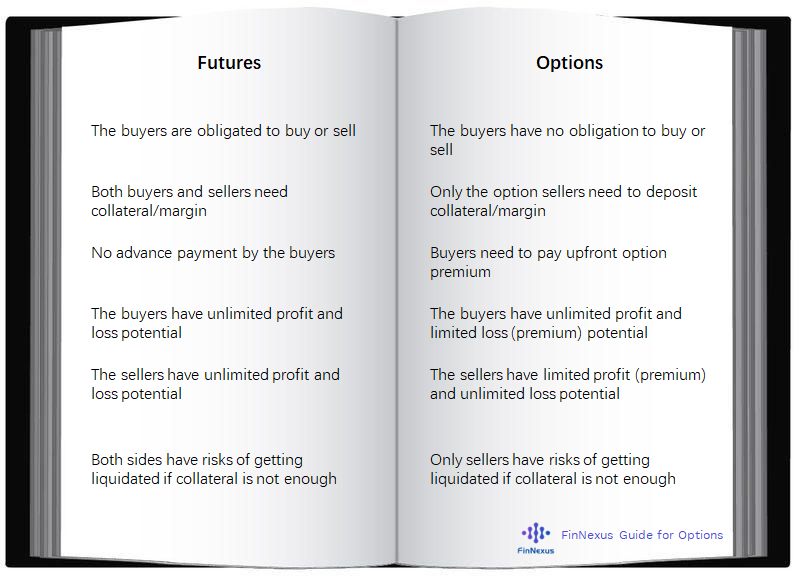

However, options and futures are fundamentally different in many aspects.

The transaction object of an options contract is a right, whereas a futures contract is binding on both sides to trade in the future. Therefore, the holder of the options may choose to exercise or stay put at his/her own discretion, while the holder of a future has to perform. This gives rise to some major differences as shown in the comparison above.

The Essentials of Options

Option Buyers and Sellers

Each option contract has two parties, the option buyer/holder and the option seller/writer. The option buyer pays the option premium and is entitled to rights only. The option seller receives the premium as consideration for giving up those rights.

Calls and Puts

Call options (or calls) allow the holder to buy an underlying asset at a certain price.

Put options (or puts) allow the holder to sell an underlying asset at a certain price.

In the specific example above, the fruit store wants to “buy” apples in August, meaning he is buying a call option contract.

Let us now suppose that it is the orchard owner who worries that the apple price may drop in August, and he wants to fix his minimum profit. To do so, he signs a contract with the fruit store, stipulating that he may sell the apples at the price of $4/kg in August, but he does not have to if the market price is higher. This contract is a typical put option contract.

Strike Price

The strike price (or exercise price) of an option is the price at which a put or call option can be exercised. For a call option, the strike price is the price at which the option holders can buy the underlying asset. For a put option, the strike price is the price at which the option holders can sell the underlying asset. It is predetermined in the options contracts.

Expiration Date

The expiration date of an option contract is the last date on which the contract is valid, meaning that the holder has the right to exercise the option according to its terms.

Holders of American-style options may exercise at any time before the option expires, while holders of European-style options may exercise only at expiration.

Exercise

Exercising an option means putting into effect the right to buy or sell the underlying assets specified in the contract, as opposed to allowing the contract to expire.

Exercising a put option enables the holder to sell the underlying asset at a stated price, and exercising a call option enables the holder to buy the underlying asset at a stated price.

To find out more about the basics of options, please check:

FinNexus Docs

Option Alpha

Options on Crypto Assets

In traditional finance, underlying assets vary. There are options on gold, petrol, exchange rates (forex options), stocks, indexes, etc.

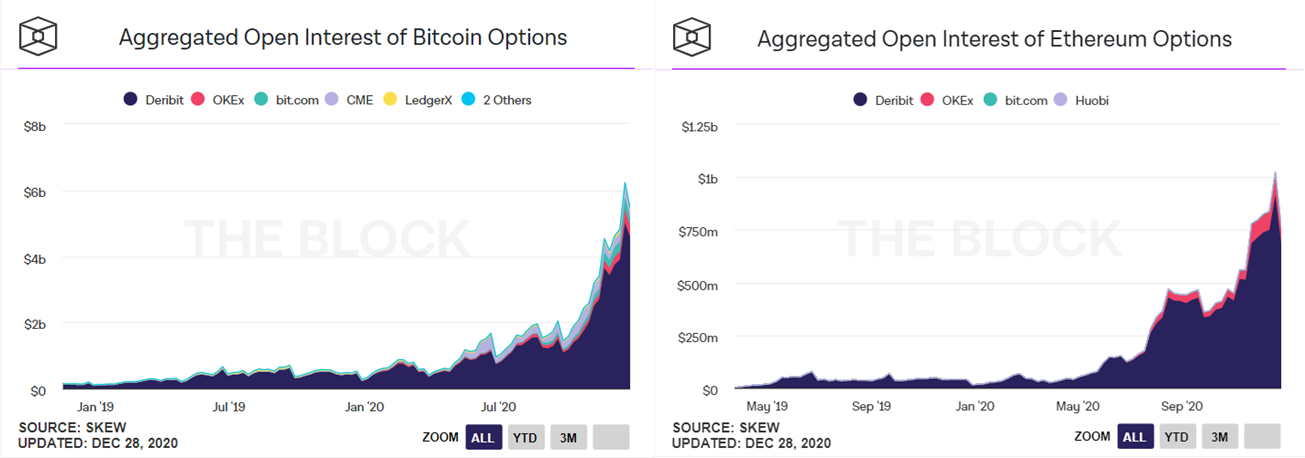

If we change the underlying assets to cryptocurrencies, we have crypto-asset options, with BTC and ETH options taking the lion’s share of the market.

Among centralized derivative exchanges, Deribit offers the deepest liquidity and controls 90% of the options market. Others like CME, Huobi, OKEx and LedgerX are all growing fast.

Source: https://www.theblockcrypto.com/data/crypto-markets/options

The open interest of BTC and ETH all reached their all-time-high in Dec 2020.

However, in 2020, with the rapid growth of DeFi, a number of decentralized options platforms have emerged - - think of Hegic, FinNexus, Opyn, Opium, Auctus, etc. - - providing decentralized on-chain solutions for trading and settling crypto option contracts.

(Here is an introduction to better understand decentralized options platforms.)

Why Are Options Useful?

Options are both useful and powerful because they can enhance the financial performance of one’s portfolio by boosting income, protection and leverage.

In traditional finance, a good example would be applying options as an effective hedge to limit downside losses. Options can also be used for speculative purposes, such as wagering on the direction of a volatile asset and to generate a recurring income by selling them.

Options Are a Cheap and Easy Way to Appreciate Your Crypto Assets

If one is a hodler of ETH, he/she may easily leverage one’s exposure to 1 ETH by longing ETH calls with a cost of only 0.2 ETH. Also, one can sell/short an ETH put and get an immediate premium, while buying the dips during a price correction.

Options come with leverage, yet due to their structure, traders who buy them do not need to worry about liquidation, since all the buyer pays is the premium which is set in advance. The option holders’ potential loss is capped while the gains can be unlimited.

Options Can Effectively Insure Your Crypto Wealth

By buying puts, one is protected from significant price drops - - think for instance about the crash of March 2020 - - with a cost as low as a mere 5%. Just as interestingly, option holders can exploit upward momentum if the market price rises over a long period of time since they can choose not to exercise their contracts, unlike with futures.

One could say options are the perfect financial instrument to help you sleep tight at night.

Options Can Be a Good Way to Manage Your Risk Exposure

Controversy surrounds the safety of crypto assets, chiefly because of their high volatility and the risks associated with coding issues. Options can be a great tool to hedge against such risks precisely because they offer unlimited gains, whilst limiting your loss to the relatively small amount you pay to hold the contract.

For option holders, the maximum loss is capped to the option premium, while benefits derived from volatility can be immense, assuming prices move in a favorable direction.